Views: 222 Author: Edvo Publish Time: 2025-11-27 Origin: Site

Content Menu

● Understanding Orthotic Shoe Inserts

>> Types of Orthotic Shoe Inserts

● IRS Medical Expense Deduction Guidelines

● Essential Documentation for Tax Claims

● How FSAs and HSAs Affect Orthotic Purchases

>> Steps for Account Reimbursement

● Claiming Orthotic Expenses: Step-by-Step Guide

● Health Conditions That Require Orthotics

● Additional Financial Planning Tips

● Misconceptions and Common Mistakes

● How Shoe Insole Manufacturers Support Tax-Advantaged Purchases

>> 1. Can I deduct non-prescription shoe inserts from my taxes?

>> 2. Do I need a prescription to claim a tax deduction for orthotics?

>> 3. Can I use both FSA/HSA funds and then claim a deduction on my tax return?

>> 4. Are work-required orthotics tax deductible?

>> 5. What documentation do I need to claim orthotic shoe inserts as a tax deduction?

Orthotic inserts are specialized products designed to address specific medical needs, improve foot alignment, and relieve pain. Many individuals wonder if the cost of such orthotics can be deducted from their taxes, especially as healthcare expenses continue to rise. In the United States and other regions, eligibility for deducting orthotic expenses hinges on several factors, including medical necessity, documentation, and compliance with IRS or local tax laws.

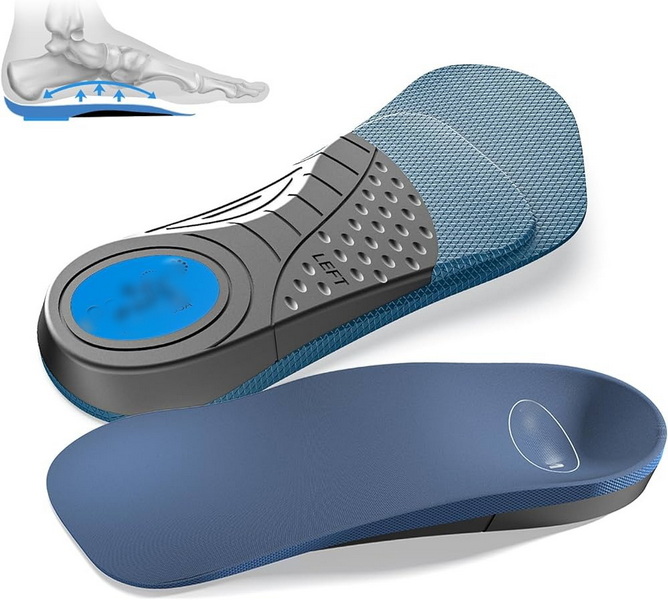

Orthotic shoe inserts, also called orthotics, range from simple prefabricated models to customized devices tailored for an individual's foot structure. They often play an essential role in managing conditions such as flat feet, plantar fasciitis, arthritis, diabetic neuropathy, and post-injury rehabilitation. By providing improved support, orthotics can also help prevent further injury or aggravation of chronic pain.

- Custom Orthotics: Designed for individual foot anatomy and prescribed for medical needs.

- Prefabricated Orthotics: Readily available retail inserts offering generic support.

- Diabetic Insoles: Engineered for patients with diabetes to prevent ulcers and other complications.

- Sport Orthotics: Built to enhance performance and reduce risk in athletic activities.

To claim a tax deduction for orthotic shoe inserts in the U.S., medical expenses must exceed a threshold of 7.5% of your adjusted gross income (AGI) and must be itemized on Schedule A of your tax return. Qualifying expenses include only non-reimbursed, prescribed medical products that treat or alleviate diagnosed medical conditions.

- Medical Prescription: Custom orthotic inserts must be prescribed by a licensed healthcare provider.

- Medical Necessity: The prescription should reference a specific diagnosis or medical condition.

- Expense Threshold: Total medical expenses (not just orthotic cost) must exceed 7.5% of AGI.

- Proof of Purchase: Detailed receipts listing the patient name, purchase date, and product information.

- No Double Dipping: Expenses paid through FSA or HSA accounts cannot be taken as Schedule A deductions.

The IRS and other tax authorities require proof to validate tax-deductible medical claims. For orthotic inserts, vital documents include:

- Physician's prescription stating the necessity for custom orthotics.

- Diagnosis details demonstrating the medical need.

- Unreimbursed purchase receipts.

- Confirmation that insurance, employer programs, or tax-advantaged accounts did not reimburse the costs.

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) are popular methods for managing medical expenses in a tax-efficient manner. These accounts allow you to pay for qualifying orthotic shoe inserts with pre-tax dollars, saving money upfront. However, if you utilize these accounts, you cannot claim the same expense as a tax-deductible item—doing so is considered double dipping.

- Obtain a letter of medical necessity and prescription from a qualified healthcare provider.

- Submit itemized invoices and proof of purchase to your FSA/HSA administrator.

- Ensure claims include relevant diagnosis and personal information.

- Monitor submission deadlines and review policy for additional fees.

- Custom orthotics for medical conditions

- Diabetic care insoles

- Orthotics for chronic pain or rehabilitation

In some cases, orthotic inserts may qualify as business expenses if they are specifically required for job-related safety or performance and are not reimbursed by an employer. This scenario applies to self-employed individuals and workers whose occupational duties demand prolonged standing or walking.

- If your occupation mandates the use of orthotic devices for performance or health.

- When unreimbursed orthotic expenses exceed applicable tax thresholds.

- Proper documentation demonstrating the relationship between job demands and medical necessity.

Not all shoe inserts qualify for tax deduction. Examples include:

- Over-the-counter insoles for general comfort or minor fatigue.

- Orthotics purchased without a medical prescription.

- Reimbursed expenses through insurance or health accounts.

Outside the United States, rules vary significantly between countries. Some regions allow for similar tax deductions on medical expenses, provided stringent documentation and eligibility requirements are met. For example, in Australia, tax law generally does not support deductions for orthotic purchases unless strict business-related provisions are satisfied.

For those aiming to maximize their savings by deducting orthotic expenses, a systematic approach is critical:

1. Seek medical evaluation and obtain a prescription.

2. Purchase custom orthotic shoe inserts.

3. Keep all relevant documentation—diagnosis, prescription, and receipts.

4. Verify total unreimbursed medical expenses exceed the deduction threshold.

5. Complete required tax forms and itemize expenses.

6. Review your eligibility for FSA/HSA reimbursement or business expense claims.

Orthotic shoe inserts help address a broad spectrum of health issues. Common qualifying diagnoses include:

- Plantar fasciitis

- Flat feet

- Post-traumatic injuries

- Arthritis

- Chronic heel pain

- Diabetic neuropathy

- Achilles tendinitis

Making the most of available tax deductions and reimbursement programs can help manage the financial burden of necessary orthotic devices. Consider these recommendations:

- Schedule regular medical reviews to assess continued need for orthotics.

- Ask about employer wellness reimbursements or stipends for orthotic products.

- Explore payment plans and refurbishment options for long-term savings.

- Consult a professional tax advisor for complex claims.

A number of pitfalls can reduce the likelihood of a successful deduction:

- Overestimating qualifying expenses below the AGI threshold.

- Failing to differentiate between custom orthotics and retail insoles.

- Not retaining proper documentation or receipts.

- Trying to claim expenses covered by HSAs or FSAs again on Schedule A.

Leading Chinese insole manufacturers, especially those offering OEM services to overseas brand owners, wholesalers, and producers, are increasingly tailoring product lines to meet medical necessity standards. Many provide robust documentation, customized solutions, and facilitate direct communication with healthcare professionals to ease the process for international buyers seeking products that qualify for tax-advantaged medical purchases.

Orthotic shoe inserts, when medically necessary and properly documented, can be tax deducted in the U.S. and selected international regions. Understanding the distinction between custom and over-the-counter inserts, leveraging HSAs and FSAs for tax advantage, and maintaining thorough records are vital for ensuring expenses qualify. Collaborating with reputable manufacturers and consulting financial professionals further improves the likelihood of successfully claiming deductions.

You cannot deduct the expense of non-prescription or over-the-counter shoe inserts purchased for comfort or basic support. Only medically prescribed, custom orthotics are eligible.

Yes, a prescription from a licensed physician or equivalent healthcare provider is necessary, and it must detail the medical condition and necessity for custom orthotics.

No, expenses paid with FSA or HSA accounts are already tax-advantaged and cannot be deducted again as unreimbursed medical expenses.

Work-required orthotics may be deductible as business expenses for self-employed persons or employees not reimbursed, but documentation must demonstrate necessity related to job duties.

A prescription, diagnosis record, receipts detailing the product and patient, and proof that the expense was not reimbursed by another program are needed.